Climate policy makers have an array of policy options to choose from to meet CO2 emission targets. The economics literature agrees that least-cost climate policy would feature carbon pricing, in the form of taxes or cap-and-trade. However, implementation efforts have shown such policies to be politically unpopular certainly at pricing levels recommended by economic theory. Political constraints may justify other, “second-best” policies from both economic efficiency and public choice theory perspectives, either because carbon pricing does not exist or because the level of the carbon price is below the efficient level. Alternative CO2-reducing policies such as low-carbon technology subsidies and standards have seen relatively wide implementation.

Standards, which mandate a given low-carbon technology share, are a particularly common form of climate policy. Such policies are employed across U.S. states in the electricity and transportation sectors. Examples include Renewable Portfolio Standards (RPS), transportation fuel standards, and more recent zero-emission vehicle standards. At the federal level, such policies include the Corporate Average Fuel Economy (CAFE) standard and the Renewable Fuel Standard. Recently, Clean Energy Standards (CES) have come to occupy a central position in U.S. Congressional debates about future climate policy.

While standards have political feasibility advantages relative to carbon pricing, they have been shown to be less economically efficient and to impose higher economic costs on low-income households. Therefore, the choice between carbon pricing and standards involves a trade-off between the relative efficiency and progressivity of carbon pricing on the one hand and the assumed political acceptability advantages of standards on the other.

A balance between these competing considerations may be achieved through a certain combination of both carbon pricing and standards. Most previous research has compared carbon pricing and standards in isolation, comparing the efficiency of a climate policy exclusively comprising one type of policy to a climate policy exclusively comprising the other type. Some research has included scenarios featuring a combination of carbon pricing and other policies. However, such studies have only considered a single pre-defined combination of these policies. Past research therefore does not sufficiently inform how policy makers can choose between different combinations of climate policies.

In this paper, we compare different combinations of standards and carbon pricing. We frame climate policy making as a choice among alternative policy portfolios that reduce the same amount of CO2 but differ with respect to how much they rely on standards or carbon pricing. The extent to which a policy portfolio “relies” on a given policy is defined in multiple ways including: the stringency of the standard, and the share of abatement caused by each policy.

A climate policy portfolio that includes carbon pricing, in addition to a standard, is expected to cost less than a pure standard-based climate policy, as found in previous literature. We define this decreases in policy cost (or increase in welfare) as the efficiency benefit of carbon pricing. To inform the choice of a policy portfolio, we explore how this efficiency benefit varies as the policy portfolio relies more or less on each policy. In other words, we investigate the marginal benefit of carbon pricing across different policy portfolios.

We approach these questions through both theory and modeling. For the latter we use two previously published models: EPPA and GenX. We run these models through a novel experimental procedure, which allows us to quantify and compare the costs of different policy portfolios.

Our modeling covers a range of policy contexts. In EPPA, we explore different combinations of economy-wide carbon pricing and three different types of low-carbon standards: an RPS, a CES, and a CAFE standard. In GenX, we model an RPS combined with power sector carbon pricing, and an RPS combined with economy-wide carbon pricing.

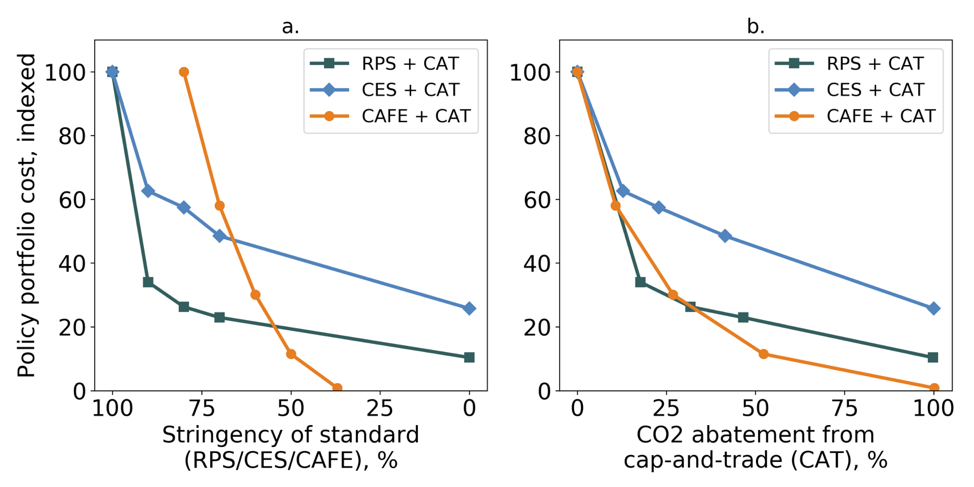

Our results from the EPPA model (shown below) illustrates our two general findings. First, a combination of a standard and carbon pricing costs less than a standard-only policy that reduces the same amount of CO2. This result reflects the cost-saving (i.e. efficiency) benefit of carbon pricing. Second, the cost-saving benefit of incorporating carbon pricing is large at first and diminishes the more a policy relies on carbon pricing as opposed to a standard. These two results are consistent with our modeling in GenX and the findings of our theoretical model.

This paper therefore suggests that lawmakers can drastically reduce policy costs if they combine low-carbon standards with modest carbon pricing, relative to the cost of relying on standards alone. These findings are particularly relevant for the design of standard-based climate policy packages, exemplified by recent national proposals.

More generally, we find potential advantages in hybrid policy portfolios that combine alternative policy tools, such as standards and carbon pricing. Policy debates have been previously framed as a choice between such options. We reconceptualize the problem as one of choice from different combinations of policy options. Envisioning alternative policy tools in concert, as we do in this paper, may provide a way to balance diverse societal criteria as well as an opportunity for consensus between advocates of either approach.

Figure 1 Each line represents a different kind of policy portfolio. For example, the dark blue line represents and RPS combined with a cap-and-trade (CAT), while the light blue line represents combinations of CES and CAT. The horizontal axes represent the extent to which the policy portfolio relies on the standard or cap-and-trade. Values to the left denote a higher reliance on the standard and values to the right show a higher reliance on the cap-and-trade. In panel “a.” reliance is defined by the stringency of the standard. In panel “b.” it is defined by the amount of abatement caused by the cap-and-trade policy (as opposed to the standard).

References

Emil G. Dimanchev and Christopher R. Knittel (2020), “Trade-offs in Climate Policy: Combining Low-Carbon Standards with Modest Carbon Pricing.” MIT CEEPR Working Paper 2020-020, November 2020.

Further Reading: CEEPR WP 2020-020

About the Authors:

| Emil Dimanchev is an External Researcher at MIT CEEPR and a Ph.D. Candidate at the Norwegian University of Science and Technology (NTNU). His research focuses on climate and energy policy design and leverages diverse techno-economic modeling methods matched to the problem at hand. Emil has testified in front of legislators on climate policy, served as a consultant to government officials on carbon pricing, and briefed senior staff at Fortune Global 500 companies | |

| Christopher R. Knittel is the George P. Shultz Professor of Applied Economics at the Sloan School of Management, Director of the Center for Energy and Environmental Policy Research, and Co-Director of the MITEI Low-Carbon Energy Center for Electric Power Systems Research at the Massachusetts Institute of Technology. He joined the faculty at MIT in 2011, having taught previously at UC Davis and Boston University. Professor Knittel received his B.A. in economics and political science from the California State University, Stanislaus in 1994 (summa cum laude), an M.A. in economics from UC Davis in 1996, and a Ph.D. in economics from UC Berkeley in 1999. His research focuses on environmental economics, industrial organization, and applied econometrics. |